Why Filing Taxes on Time is Crucial

Filing taxes on time is essential for individuals and businesses to avoid penalties, interest, and potential audits. The Internal Revenue Service (IRS) imposes penalties and interest on late filers, which can add up quickly. For instance, the failure-to-file penalty can be as high as 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. Additionally, interest accrues on both the unpaid taxes and the penalties, further increasing the amount owed.

On the other hand, timely filing can help with refund processing and other financial benefits. The IRS typically processes refunds within 2-3 weeks of receiving a tax return, providing individuals with access to their hard-earned money sooner. Moreover, filing taxes on time can help individuals and businesses take advantage of tax credits and deductions, reducing their tax liability and increasing their refund.

Furthermore, filing taxes on time can also help individuals and businesses avoid potential audits. The IRS is more likely to audit tax returns that are filed late or contain errors, which can lead to additional penalties and interest. By filing taxes on time and accurately, individuals and businesses can reduce their risk of being audited and avoid the associated stress and financial burden.

In the event that an individual or business is unable to file their taxes on time, it is essential to understand what happens if they file their taxes late. The consequences of late filing can be severe, and it is crucial to take proactive steps to minimize penalties and interest. By understanding the importance of timely filing and taking steps to avoid late filing penalties, individuals and businesses can ensure they are in compliance with tax laws and regulations.

What Happens When You File Taxes Late?

Filing taxes late can have serious consequences, including the imposition of penalties and interest on the amount owed. The IRS calculates these fees based on the amount of taxes owed and the number of months or quarters the taxes are late. For example, the failure-to-file penalty can be as high as 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. Additionally, interest accrues on both the unpaid taxes and the penalties, further increasing the amount owed.

The IRS also imposes a failure-to-pay penalty, which can be as high as 0.5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. This penalty is in addition to the failure-to-file penalty and interest. Furthermore, the IRS may also impose additional penalties, such as the accuracy-related penalty, if the taxpayer is found to have made errors or omissions on their tax return.

It’s essential to understand that the IRS calculates penalties and interest on a daily basis, so the longer the taxpayer waits to file and pay their taxes, the more they will owe. For instance, if a taxpayer owes $1,000 in taxes and files their return 6 months late, they may be subject to a failure-to-file penalty of $150 (5% of $1,000 x 6 months) and interest of $60 (6% of $1,000 x 6 months). This would bring the total amount owed to $1,210.

In addition to the financial consequences, filing taxes late can also lead to other problems, such as delayed refunds, lost tax credits, and even tax audits. The IRS may also file a substitute return on behalf of the taxpayer, which can lead to additional penalties and interest.

It’s crucial to take proactive steps to minimize penalties and interest if you’ve missed the tax deadline. This may include filing for an extension, making partial payments, or seeking professional help from a tax professional or accountant. By understanding the consequences of filing taxes late, taxpayers can take control of their tax obligations and avoid unnecessary penalties and interest.

How to File Taxes Late and Minimize Penalties

If you’ve missed the tax deadline, it’s essential to take immediate action to minimize penalties and interest. The first step is to gather all necessary forms and documentation, including your W-2s, 1099s, and any other relevant tax documents. You’ll also need to complete Form 1040, which is the standard form for personal income tax returns.

Once you have all the necessary documents, you can file your tax return electronically or by mail. If you’re filing electronically, you can use tax preparation software, such as TurboTax or H&R Block, to guide you through the process. If you’re filing by mail, make sure to use the correct address and include all required forms and documentation.

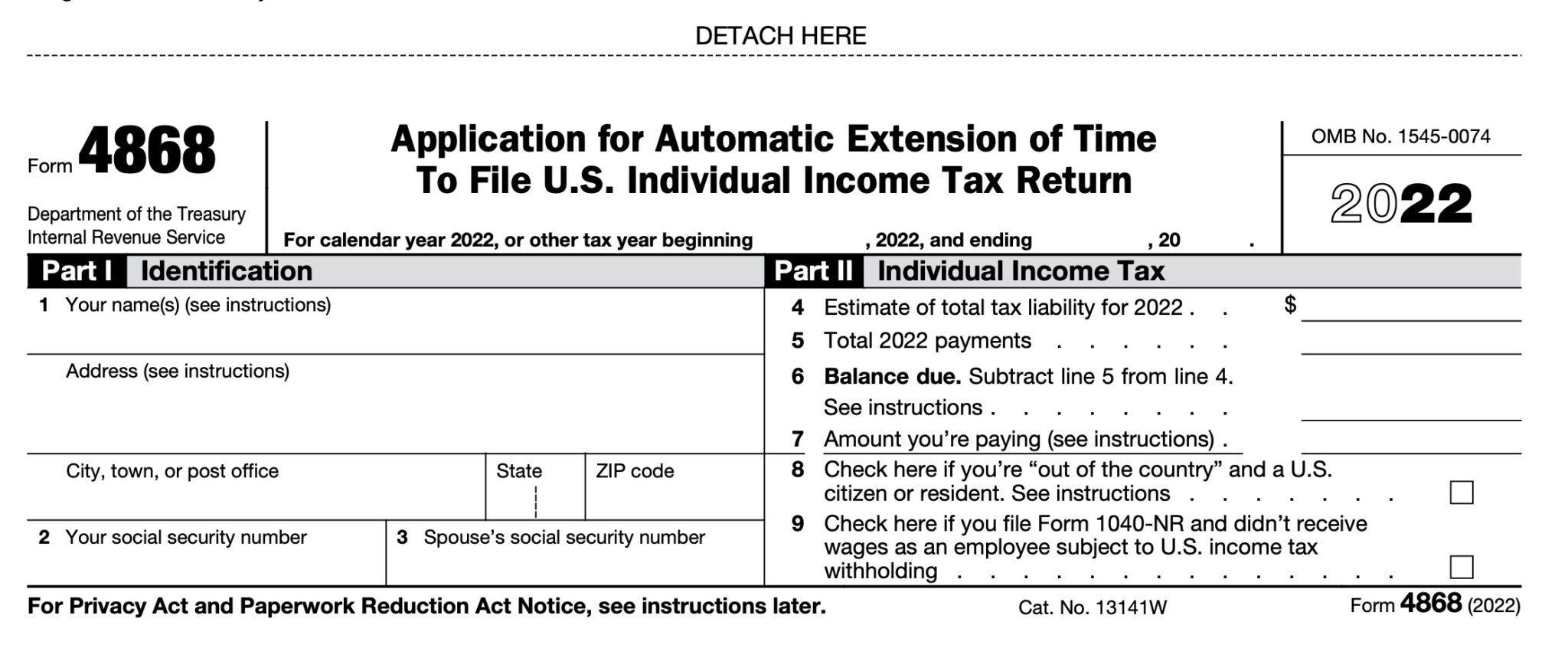

To minimize penalties, consider filing for an extension using Form 4868. This will give you an additional six months to file your tax return, but keep in mind that you’ll still need to pay any taxes owed by the original deadline to avoid penalties and interest. You can also make partial payments to reduce the amount of penalties and interest owed.

Another option is to file for a payment plan using Form 9465. This will allow you to make monthly payments towards your tax bill, but you’ll need to pay a setup fee and interest on the outstanding balance. You can also consider making an offer in compromise, which is a settlement with the IRS for less than the full amount owed.

It’s also important to note that the IRS offers several options for taxpayers who are unable to pay their tax bill, including installment agreements, currently not collectible status, and offers in compromise. These options can help you avoid penalties and interest, but you’ll need to meet specific requirements and follow the necessary procedures.

By taking proactive steps to file your taxes late and minimize penalties, you can avoid unnecessary fees and interest. Remember to prioritize timely filing and seek help if needed to avoid penalties and interest. If you’re unsure about the best course of action, consider seeking professional help from a tax professional or accountant.

Understanding IRS Penalties and Interest Rates

The IRS imposes various penalties and interest rates on taxpayers who file their taxes late. Understanding these penalties and interest rates can help taxpayers minimize their tax liability and avoid additional fees. The most common penalties and interest rates imposed by the IRS include:

Failure-to-File Penalty: This penalty is imposed on taxpayers who fail to file their tax return by the deadline. The penalty is calculated as 5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. For example, if a taxpayer owes $1,000 in taxes and files their return 6 months late, they may be subject to a failure-to-file penalty of $150 (5% of $1,000 x 6 months).

Failure-to-Pay Penalty: This penalty is imposed on taxpayers who fail to pay their taxes by the deadline. The penalty is calculated as 0.5% of the unpaid taxes for each month or part of a month, up to a maximum of 25%. For example, if a taxpayer owes $1,000 in taxes and pays their bill 6 months late, they may be subject to a failure-to-pay penalty of $30 (0.5% of $1,000 x 6 months).

Interest Rates: The IRS charges interest on unpaid taxes, starting from the original deadline. The interest rate is determined quarterly and is based on the federal short-term rate plus 3%. For example, if a taxpayer owes $1,000 in taxes and pays their bill 6 months late, they may be subject to interest charges of $60 (6% of $1,000 x 6 months).

Accuracy-Related Penalty: This penalty is imposed on taxpayers who are found to have made errors or omissions on their tax return. The penalty is calculated as 20% of the unpaid taxes. For example, if a taxpayer owes $1,000 in taxes and is found to have made an error on their return, they may be subject to an accuracy-related penalty of $200 (20% of $1,000).

By understanding the various penalties and interest rates imposed by the IRS, taxpayers can take steps to minimize their tax liability and avoid additional fees. It’s essential to prioritize timely filing and payment to avoid these penalties and interest rates.

How to Avoid Late Filing Penalties in the Future

To avoid late filing penalties in the future, it’s essential to prioritize timely filing and take proactive steps to ensure you meet the tax deadline. Here are some tips to help you avoid late filing penalties:

Set Reminders: Set reminders for the tax deadline and important tax-related dates, such as the deadline for filing an extension or making quarterly estimated tax payments. You can set reminders on your calendar, phone, or computer to ensure you stay on track.

Use Tax Preparation Software: Utilize tax preparation software, such as TurboTax or H&R Block, to help you prepare and file your taxes. These programs can guide you through the tax preparation process and help you avoid errors and omissions.

Seek Professional Help: Consider seeking professional help from a tax professional or accountant if you’re unsure about how to prepare your taxes or need assistance with complex tax issues. They can provide expert guidance and help you avoid late filing penalties.

File Electronically: File your taxes electronically using the IRS’s e-file program. This can help you avoid errors and omissions, and ensure your return is processed quickly and efficiently.

Use the IRS’s Free File Program: If you’re eligible, use the IRS’s free file program to prepare and file your taxes. This program is available to taxpayers who earn below a certain income threshold and can help you avoid late filing penalties.

Make Quarterly Estimated Tax Payments: Make quarterly estimated tax payments to avoid penalties and interest on unpaid taxes. You can use Form 1040-ES to make these payments.

By following these tips, you can avoid late filing penalties and ensure you meet the tax deadline. Remember, timely filing is crucial to avoiding penalties and interest, and seeking professional help can provide you with the expertise and guidance you need to navigate complex tax issues.

What to Do If You Can’t Pay Your Tax Bill

If you’re unable to pay your tax bill, there are several options available to help you manage your debt. The IRS offers various payment plans and alternatives to help taxpayers who are struggling to pay their tax bills. Here are some options

What to Do If You Can’t Pay Your Tax Bill

If you’re unable to pay your tax bill, there are several options available to help you manage your debt. The IRS offers various payment plans and alternatives to help taxpayers who are struggling to pay their tax bills. Here are some options

What to Do If You Can’t Pay Your Tax Bill

If you’re unable to pay your tax bill, there are several options available to help you manage your debt. The IRS offers various payment plans and alternatives to help taxpayers who are struggling to pay their tax bills. Here are some options