What is a Copay and How Does it Work?

A copay, short for copayment, is a fixed amount that patients pay for healthcare services, such as doctor visits, prescription medications, or hospital stays. It is a type of out-of-pocket cost that is typically paid at the time of service. Understanding what a copay is and how it works is essential for managing healthcare expenses and making informed decisions about care.

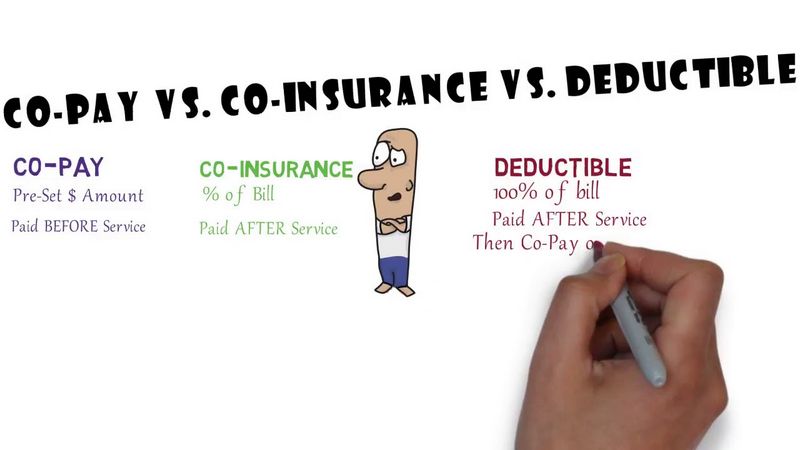

Copays differ from coinsurance and deductibles, which are other types of out-of-pocket costs. Coinsurance is a percentage of the total cost of a healthcare service, while deductibles are the amount that patients must pay before their insurance plan kicks in. For example, a patient may have a $20 copay for a doctor visit, while also having a 20% coinsurance for hospital stays and a $1,000 deductible for the year.

Copays can vary depending on the healthcare provider, insurance plan, and type of service. For instance, a patient may have a $10 copay for a primary care physician visit, but a $50 copay for a specialist visit. Some insurance plans may also have different copay amounts for different types of services, such as prescription medications or emergency room visits.

It’s essential to review your insurance plan documents to understand what copays apply to your care. You can also ask your healthcare provider or insurance company about copays and other out-of-pocket costs associated with your care. By understanding what a copay is and how it works, you can better manage your healthcare expenses and make informed decisions about your care.

In addition to copays, patients may also be responsible for other out-of-pocket costs, such as coinsurance and deductibles. It’s crucial to understand how these costs work together to ensure that you’re prepared for any healthcare expenses that may arise. By taking the time to understand your insurance plan and the associated costs, you can take control of your healthcare expenses and make informed decisions about your care.

Overall, copays are an essential aspect of healthcare expenses, and understanding what they are and how they work is vital for managing costs and making informed decisions about care. By knowing what to expect and how to navigate the healthcare system, patients can take control of their healthcare expenses and ensure that they receive the care they need.

How to Reduce Your Copays and Save on Healthcare Costs

Reducing copays and saving on healthcare costs requires a combination of strategy, planning, and negotiation. By understanding how copays work and taking proactive steps, individuals can minimize their out-of-pocket expenses and make the most of their health insurance benefits.

One effective way to reduce copays is to choose in-network providers. In-network providers have a contractual agreement with the insurance company to provide discounted services, which can result in lower copays. Patients can check their insurance plan’s provider directory to find in-network providers in their area.

Another strategy is to negotiate with healthcare providers. Patients can ask their providers about available discounts or promotions, especially for services that are not covered by insurance. Some providers may offer package deals or discounts for cash payments.

Copay coupons are also a valuable resource for reducing copays. Many pharmaceutical companies and healthcare providers offer coupons or discount programs for prescription medications and other services. Patients can search online or check with their providers to find available coupons.

Additionally, patients can take advantage of preventive care services, which are often covered by insurance without a copay. Regular check-ups, screenings, and vaccinations can help prevent illnesses and reduce healthcare costs in the long run.

It’s also essential to review and understand the insurance plan’s copay structure. Patients should know what copays apply to different services, such as doctor visits, prescription medications, or hospital stays. By understanding the copay structure, patients can plan accordingly and make informed decisions about their care.

Furthermore, patients can use online resources to compare prices and find affordable healthcare options. Websites like Healthcare.gov or GoodRx can help patients find discounted prices for prescription medications and other services.

By implementing these strategies, individuals can reduce their copays and save on healthcare costs. It’s crucial to be proactive and take control of healthcare expenses to ensure that medical bills do not become a financial burden.

Remember, understanding copays and taking steps to reduce them can make a significant difference in healthcare costs. By being informed and proactive, patients can make the most of their health insurance benefits and achieve better health outcomes.

Copays vs. Coinsurance: What’s the Difference?

Understanding the difference between copays and coinsurance is essential for managing healthcare costs. While both terms refer to out-of-pocket expenses, they are calculated and applied differently.

A copay is a fixed amount paid for a specific healthcare service, such as a doctor visit or prescription medication. Copays are usually a flat fee, and the amount is determined by the insurance plan. For example, a patient may have a $20 copay for a primary care physician visit.

Coinsurance, on the other hand, is a percentage of the total cost of a healthcare service. Coinsurance is usually applied after the deductible has been met, and the percentage is determined by the insurance plan. For instance, a patient may have a 20% coinsurance for hospital stays, which means they would pay 20% of the total cost, and the insurance company would pay the remaining 80%.

To illustrate the difference, consider the following example: A patient has a $1,000 hospital bill, and their insurance plan has a $500 deductible and 20% coinsurance. The patient would pay the first $500 (deductible), and then 20% of the remaining $500 (coinsurance), which is $100. The insurance company would pay the remaining $400.

In contrast, if the patient had a copay for the hospital stay, they would pay a fixed amount, such as $200, regardless of the total cost of the stay.

It’s essential to understand how copays and coinsurance work together to determine the total out-of-pocket cost for healthcare services. By knowing the difference between these two terms, patients can better manage their healthcare expenses and make informed decisions about their care.

Additionally, patients should review their insurance plan documents to understand how copays and coinsurance are applied to different services. This information can help patients plan accordingly and avoid unexpected medical bills.

In summary, copays and coinsurance are two different types of out-of-pocket expenses that are calculated and applied differently. Understanding the difference between these two terms is crucial for managing healthcare costs and making informed decisions about care.

Common Copay Scenarios: What to Expect

Copays can vary depending on the healthcare provider, insurance plan, and type of service. Here are some common copay scenarios and what you can expect:

Doctor Visits: Copays for doctor visits can range from $20 to $50, depending on the type of doctor and the insurance plan. For example, a primary care physician visit may have a $20 copay, while a specialist visit may have a $50 copay.

Prescription Medications: Copays for prescription medications can vary depending on the type of medication and the insurance plan. For example, a generic medication may have a $10 copay, while a brand-name medication may have a $30 copay.

Emergency Room Visits: Copays for emergency room visits can be higher than other services, ranging from $50 to $100 or more. However, some insurance plans may waive the copay for emergency room visits if the patient is admitted to the hospital.

Lab Tests and Imaging: Copays for lab tests and imaging services, such as X-rays and MRIs, can range from $20 to $50 or more, depending on the type of test and the insurance plan.

Physical Therapy: Copays for physical therapy sessions can range from $20 to $50 or more, depending on the type of therapy and the insurance plan.

It’s essential to review your insurance plan documents to understand what copays apply to different services. You can also ask your healthcare provider or insurance company about copays and other out-of-pocket costs associated with your care.

Additionally, copays can vary depending on the healthcare provider’s network status. In-network providers typically have lower copays than out-of-network providers. It’s crucial to check with your insurance plan to see if your healthcare provider is in-network or out-of-network.

By understanding common copay scenarios, you can better manage your healthcare expenses and make informed decisions about your care. Remember to always review your insurance plan documents and ask questions about copays and other out-of-pocket costs to ensure you’re prepared for any medical expenses that may arise.

Maximizing Your Health Insurance Benefits: A Guide to Copays and More

To get the most out of your health insurance plan, it’s essential to understand how copays, deductibles, and out-of-pocket maximums work together. By knowing how these components interact, you can make informed decisions about your care and minimize your healthcare expenses.

Copays are a crucial aspect of health insurance plans, as they can significantly impact your out-of-pocket costs. By understanding how copays work, you can choose the right plan and provider network to meet your healthcare needs.

Deductibles are another important component of health insurance plans. A deductible is the amount you must pay out-of-pocket before your insurance plan kicks in. By understanding how deductibles work, you can plan accordingly and avoid unexpected medical bills.

Out-of-pocket maximums are the maximum amount you must pay for healthcare expenses within a calendar year. By understanding how out-of-pocket maximums work, you can budget accordingly and avoid financial surprises.

To maximize your health insurance benefits, it’s essential to choose the right plan and provider network. Consider the following factors when selecting a plan:

Network providers: Make sure the plan’s network includes your primary care physician and any specialists you may need to see.

Copays and deductibles: Understand how copays and deductibles work and how they will impact your out-of-pocket costs.

Out-of-pocket maximums: Consider the plan’s out-of-pocket maximum and how it will impact your budget.

Prescription medication coverage: If you take prescription medications, make sure the plan covers them and understand how copays work for medications.

By considering these factors and understanding how copays, deductibles, and out-of-pocket maximums work together, you can maximize your health insurance benefits and minimize your healthcare expenses.

Remember, health insurance plans can be complex, so it’s essential to take the time to understand how they work. By doing so, you can make informed decisions about your care and take control of your healthcare costs.

Copays and Prescription Medications: What You Need to Know

Copays for prescription medications can vary depending on the type of medication, the insurance plan, and the healthcare provider. Understanding how copays work for prescription medications can help you manage your healthcare expenses and make informed decisions about your care.

There are several types of copays for prescription medications, including:

Generic copays: These are copays for generic medications, which are typically lower-cost versions of brand-name medications.

Brand-name copays: These are copays for brand-name medications, which are typically higher-cost than generic medications.

Specialty copays: These are copays for specialty medications, which are typically high-cost medications used to treat complex or rare conditions.

Copays for prescription medications can range from $10 to $50 or more, depending on the type of medication and the insurance plan. For example, a generic medication may have a $10 copay, while a brand-name medication may have a $30 copay.

It’s essential to review your insurance plan documents to understand how copays work for prescription medications. You can also ask your healthcare provider or insurance company about copays and other out-of-pocket costs associated with your care.

In addition to copays, there may be other costs associated with prescription medications, such as deductibles and coinsurance. Understanding how these costs work together can help you manage your healthcare expenses and make informed decisions about your care.

Some insurance plans may also offer copay coupons or discounts for prescription medications. These can be a useful way to reduce your out-of-pocket costs and make your medications more affordable.

By understanding how copays work for prescription medications, you can take control of your healthcare expenses and make informed decisions about your care. Remember to always review your insurance plan documents and ask questions about copays and other out-of-pocket costs to ensure you’re prepared for any medical expenses that may arise.

Navigating the Healthcare System: Tips for Managing Copays and Costs

Navigating the healthcare system can be complex and overwhelming, especially when it comes to managing copays and costs. However, by understanding how to ask about copays and costs, how to negotiate with providers, and how to appeal denied claims, you can take control of your healthcare expenses and make informed decisions about your care.

Asking about copays and costs is an essential step in managing your healthcare expenses. When visiting a healthcare provider, ask about the copay amount and any additional costs associated with the visit. You can also ask about the cost of prescription medications and any other services or treatments.

Negotiating with providers is another effective way to manage copays and costs. If you are unable to pay a copay or other costs, ask your provider if they offer any discounts or payment plans. Some providers may also offer sliding scale fees or other forms of financial assistance.

Appealing denied claims is also an important step in managing copays and costs. If your insurance company denies a claim, you have the right to appeal the decision. Be sure to review your insurance plan documents and understand the appeals process before submitting a claim.

Additionally, understanding your insurance plan’s network and provider directory can help you manage copays and costs. Make sure to choose in-network providers to minimize copays and other costs.

It’s also essential to keep track of your copays and costs throughout the year. Keep a record of your copays and other expenses, and review your insurance plan documents regularly to ensure you are meeting your deductible and out-of-pocket maximum.

By following these tips and taking an active role in managing your copays and costs, you can take control of your healthcare expenses and make informed decisions about your care. Remember to always ask questions and seek clarification when needed, and don’t be afraid to negotiate with providers or appeal denied claims.

By being proactive and informed, you can navigate the healthcare system with confidence and make the most of your healthcare benefits.

Conclusion: Taking Control of Your Healthcare Costs

In conclusion, understanding copays and how they work is crucial for managing healthcare costs and making informed decisions about care. By knowing what a copay is, how it differs from coinsurance and deductibles, and how to minimize copays, individuals can take control of their healthcare expenses and make the most of their health insurance benefits.

Throughout this article, we have discussed various aspects of copays, including common copay scenarios, how to reduce copays, and how to navigate the healthcare system. We have also emphasized the importance of understanding copays and making informed decisions about care.

By taking an active role in managing healthcare costs, individuals can avoid unexpected medical bills, reduce financial stress, and improve their overall health and well-being. Remember, understanding copays is just the first step in taking control of your healthcare costs.

By being proactive and informed, individuals can make the most of their health insurance benefits and achieve better health outcomes. Don’t let copays and healthcare costs catch you off guard – take control of your healthcare expenses today and start making informed decisions about your care.

By following the tips and strategies outlined in this article, individuals can minimize copays, reduce healthcare costs, and take control of their healthcare expenses. Remember, understanding copays is key to making informed decisions about care and achieving better health outcomes.

In summary, copays are an essential aspect of healthcare costs, and understanding how they work is crucial for managing healthcare expenses and making informed decisions about care. By taking an active role in managing copays and healthcare costs, individuals can achieve better health outcomes, reduce financial stress, and improve their overall well-being.