What is a Transit Bank Number and Why is it Important?

A transit bank number, also known as a routing number, is a unique nine-digit code assigned to a financial institution by the American Bankers Association (ABA). This code plays a crucial role in the banking system, facilitating the exchange of funds between banks and financial institutions. The transit bank number is used to identify the bank and location where an account is held, ensuring that transactions are processed accurately and efficiently.

In essence, a transit bank number serves as an address for your bank account, allowing financial institutions to direct deposits, withdrawals, and other transactions to the correct location. This code is typically found on the bottom left corner of a check, on bank statements, or on online banking platforms.

Understanding what a transit bank number is and its significance in the banking system is essential for individuals and businesses alike. By recognizing the importance of this code, users can ensure seamless transactions, avoid errors, and maintain the security of their financial information.

The transit bank number is a critical component of the banking infrastructure, enabling the smooth operation of various financial services, including direct deposits, automatic payments, and wire transfers. Its accuracy and security are paramount, as any errors or discrepancies can result in delayed or failed transactions.

In the next section, we will explore how to identify your transit bank number and provide a step-by-step guide on how to locate it on your bank statements, checks, or online banking platforms.

How to Identify Your Transit Bank Number

Locating your transit bank number is a straightforward process that can be completed in a few simple steps. To identify your transit bank number, follow these steps:

1. Check your bank statements: Your transit bank number is usually printed on the bottom left corner of your bank statements. Look for a nine-digit code that starts with a zero.

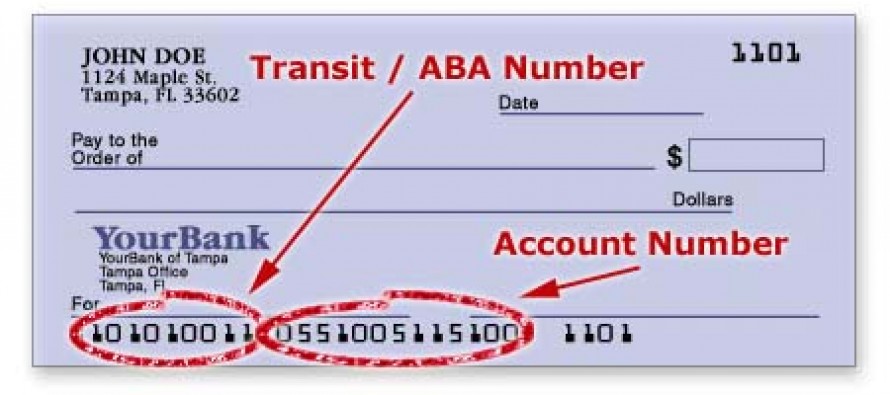

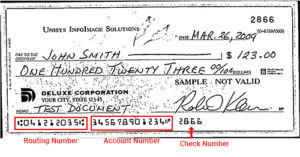

2. Examine your checks: The transit bank number is also printed on the bottom left corner of your checks, usually in the MICR (Magnetic Ink Character Recognition) line.

3. Log in to your online banking platform: Most online banking platforms display your transit bank number on the account summary or account details page.

4. Contact your bank’s customer support: If you are unable to locate your transit bank number using the above methods, you can contact your bank’s customer support team for assistance.

It’s essential to ensure that you have the correct transit bank number to avoid any errors or discrepancies in your financial transactions.

Here’s an example of what a transit bank number looks like:

In the next section, we will discuss the role of transit bank numbers in facilitating direct deposits and payments, and explain how they ensure accurate and secure transactions.

The Role of Transit Bank Numbers in Direct Deposits and Payments

Transit bank numbers play a vital role in facilitating direct deposits, automatic payments, and other financial transactions. These numbers ensure that funds are transferred accurately and securely between banks and financial institutions.

In the case of direct deposits, the transit bank number is used to identify the bank and location where the funds are to be deposited. This ensures that the funds are credited to the correct account, eliminating the risk of errors or discrepancies.

Similarly, when making automatic payments, the transit bank number is used to verify the identity of the bank and account holder. This ensures that the payment is processed correctly and that the funds are deducted from the correct account.

The use of transit bank numbers in financial transactions provides several benefits, including:

- Improved accuracy: Transit bank numbers reduce the risk of errors or discrepancies in financial transactions.

- Enhanced security: Transit bank numbers ensure that funds are transferred securely between banks and financial institutions.

- Increased efficiency: Transit bank numbers streamline the payment process, reducing the time and effort required to complete transactions.

Overall, transit bank numbers are an essential component of the banking system, enabling the smooth and secure transfer of funds between banks and financial institutions.

It’s worth noting that transit bank numbers are also used in other financial transactions, such as wire transfers and electronic funds transfers. In these cases, the transit bank number is used to identify the bank and location where the funds are to be transferred.

In the next section, we will explore the difference between transit bank numbers and account numbers, and discuss their unique purposes and uses in banking transactions.

Transit Bank Numbers vs. Account Numbers: What’s the Difference?

When it comes to banking, it’s essential to understand the difference between transit bank numbers and account numbers. While both numbers are used to identify and facilitate financial transactions, they serve distinct purposes and have different uses.

A transit bank number, as we’ve discussed earlier, is a unique nine-digit code assigned to a financial institution by the American Bankers Association (ABA). This number identifies the bank and location where an account is held, ensuring that transactions are processed accurately and securely.

An account number, on the other hand, is a unique identifier assigned to a specific account within a bank. This number is used to identify the account holder and the account itself, allowing for transactions to be processed and recorded accurately.

The key differences between transit bank numbers and account numbers are:

- Transit bank numbers identify the bank and location, while account numbers identify the account holder and account.

- Transit bank numbers are used for transactions between banks, while account numbers are used for transactions within a bank.

- Transit bank numbers are typically nine digits long, while account numbers can vary in length and format.

Understanding the difference between transit bank numbers and account numbers is crucial for accurate and secure financial transactions. By knowing how to use these numbers correctly, you can ensure that your transactions are processed smoothly and efficiently.

In the next section, we will explore how to use your transit bank number for online banking and bill payments, providing instructions on how to set up online banking and transfer funds securely and efficiently.

How to Use Your Transit Bank Number for Online Banking and Bill Payments

Using your transit bank number for online banking and bill payments is a convenient and secure way to manage your finances. Here’s a step-by-step guide on how to use your transit bank number for online banking and bill payments:

1. Log in to your online banking platform: Go to your bank’s website and log in to your online banking account using your username and password.

2. Set up your transit bank number: Once you’re logged in, navigate to the account settings or profile section and look for the option to add or update your transit bank number.

3. Enter your transit bank number: Enter your nine-digit transit bank number in the required field. Make sure to double-check the number to ensure accuracy.

4. Verify your account information: Review your account information to ensure that it’s accurate and up-to-date.

5. Set up bill payments: Once your transit bank number is set up, you can use it to pay bills online. Simply navigate to the bill payment section, select the bill you want to pay, and enter the required payment information.

6. Transfer funds: You can also use your transit bank number to transfer funds between accounts or to other banks. Simply navigate to the transfer funds section, select the account you want to transfer from, and enter the required transfer information.

By following these steps, you can use your transit bank number to manage your finances online and take advantage of the convenience and security that online banking offers.

Remember to always keep your transit bank number confidential and secure to prevent unauthorized access and potential fraud.

In the next section, we will discuss the importance of keeping your transit bank number secure and offer tips on how to protect it from unauthorized access and potential fraud.

Security Measures to Protect Your Transit Bank Number

Protecting your transit bank number is crucial to prevent unauthorized access and potential fraud. Here are some security measures you can take to safeguard your transit bank number:

1. Keep your transit bank number confidential: Do not share your transit bank number with anyone, unless it is absolutely necessary. Make sure to only provide your transit bank number to trusted individuals or institutions.

2. Use strong passwords and authentication: When accessing your online banking account, use strong passwords and authentication methods, such as two-factor authentication, to prevent unauthorized access.

3. Monitor your account activity: Regularly monitor your account activity to detect any suspicious transactions or activity. Report any discrepancies or errors to your bank immediately.

4. Use secure online banking platforms: Only use secure online banking platforms that have robust security measures in place, such as encryption and firewalls, to protect your transit bank number and account information.

5. Avoid phishing scams: Be cautious of phishing scams that may attempt to obtain your transit bank number or account information. Never provide your transit bank number or account information in response to an unsolicited email or phone call.

By taking these security measures, you can protect your transit bank number and prevent unauthorized access and potential fraud.

Remember, your transit bank number is a sensitive piece of information that requires careful handling and protection.

In the next section, we will discuss common issues that may arise with transit bank numbers and provide guidance on how to troubleshoot and resolve these issues.

Common Issues with Transit Bank Numbers and How to Resolve Them

Despite their importance, transit bank numbers can sometimes cause issues or discrepancies in banking transactions. Here are some common problems that may arise with transit bank numbers and how to resolve them:

1. Incorrect transit bank number: If you enter an incorrect transit bank number, your transaction may be rejected or delayed. To resolve this issue, double-check your transit bank number and re-enter it correctly.

2. Transit bank number not recognized: If your transit bank number is not recognized by the bank or financial institution, you may need to contact their customer support team to resolve the issue.

3. Discrepancies in account information: If there are discrepancies in your account information, such as an incorrect account number or name, it may affect your transit bank number. To resolve this issue, contact your bank’s customer support team to update your account information.

4. Technical issues with online banking: Technical issues with online banking platforms can sometimes cause problems with transit bank numbers. To resolve this issue, try clearing your browser cache or contacting your bank’s technical support team.

5. Security issues with transit bank numbers: If you suspect that your transit bank number has been compromised or is being used for unauthorized transactions, contact your bank’s customer support team immediately to report the issue and take necessary action.

By being aware of these common issues and knowing how to resolve them, you can ensure that your transit bank number is used correctly and efficiently in your banking transactions.

In the next section, we will summarize the key takeaways from the article, reiterating the significance of understanding and using transit bank numbers correctly for efficient and secure banking transactions.

Conclusion: Mastering the Transit Bank Number for Seamless Banking

In conclusion, understanding what is a transit bank number and its significance in the banking system is crucial for efficient and secure financial transactions. By grasping the concept of transit bank numbers and their role in direct deposits, automatic payments, and online banking, individuals can ensure accurate and timely transactions. It is essential to distinguish between transit bank numbers and account numbers, as they serve unique purposes in banking transactions.

By following the step-by-step guide on how to locate and use transit bank numbers, individuals can set up online banking, pay bills, and transfer funds securely and efficiently. Moreover, it is vital to keep transit bank numbers confidential and secure to prevent unauthorized access and potential fraud. By being aware of common issues that may arise with transit bank numbers and knowing how to troubleshoot and resolve them, individuals can avoid unnecessary delays and complications.

In today’s digital age, having a solid understanding of transit bank numbers is more important than ever. By mastering the transit bank number, individuals can take control of their financial transactions, ensure seamless banking experiences, and avoid potential pitfalls. Whether it’s setting up direct deposits, paying bills online, or transferring funds, a clear understanding of transit bank numbers is essential for navigating the complex world of banking with confidence.

As the banking system continues to evolve, it is crucial to stay informed about the latest developments and best practices in banking. By staying up-to-date on the role of transit bank numbers in modern banking, individuals can ensure they are making the most of their financial transactions and avoiding unnecessary complications. With this comprehensive guide, individuals can unlock the mystery of transit bank numbers and take the first step towards mastering the art of seamless banking.