Why Traditional Income Streams May Not Be Enough

For many individuals, the traditional 9-to-5 job is no longer a guarantee of financial stability and freedom. With rising living costs, stagnant wages, and an increasingly uncertain job market, it’s becoming clear that relying solely on a single income stream may not be enough to achieve long-term financial success. The question on many people’s minds is, what’s the best way to earn money and secure a stable financial future?

In today’s fast-paced and ever-changing economy, it’s essential to think beyond the traditional salary and explore alternative income streams. This could include freelancing, investing, or starting a side business. By diversifying one’s income streams, individuals can reduce their financial risk and increase their earning potential. Moreover, having multiple income streams can provide a sense of security and peace of mind, knowing that if one stream is disrupted, others can help make up for the loss.

Furthermore, traditional income streams often come with limitations, such as limited career advancement opportunities, restrictive work schedules, and a lack of autonomy. In contrast, alternative income streams can offer more flexibility, creativity, and fulfillment. For instance, freelancing allows individuals to choose their projects, set their rates, and work on their own terms. Similarly, investing in stocks or real estate can provide a sense of ownership and control over one’s financial destiny.

Ultimately, the key to achieving long-term financial success is to think creatively and explore new opportunities. By doing so, individuals can unlock their earning potential, reduce their financial stress, and achieve a more secure and prosperous future. So, what’s the best way to earn money? The answer lies in diversifying one’s income streams and exploring alternative opportunities that can provide a sense of freedom, flexibility, and fulfillment.

How to Diversify Your Income Streams for Maximum Earning Potential

Diversifying income streams is a crucial strategy for reducing financial risk and increasing earning potential. By having multiple sources of income, individuals can ensure that they are not reliant on a single stream, which can be vulnerable to market fluctuations, job loss, or other unforeseen circumstances. So, what’s the best way to earn money and achieve financial stability? The answer lies in exploring alternative income streams and diversifying one’s portfolio.

Freelancing is one example of an alternative income stream that can provide a sense of freedom and flexibility. By offering services on a freelance basis, individuals can choose their projects, set their rates, and work on their own terms. This can be a lucrative option for those with specialized skills, such as writing, designing, or programming.

Investing is another way to diversify income streams and potentially earn passive income. This can include investing in stocks, real estate, or peer-to-peer lending. By investing wisely, individuals can generate a steady stream of income that is not dependent on their active involvement.

Entrepreneurship is also a viable option for those looking to diversify their income streams. By starting a business, individuals can create a new source of income that is not reliant on a single employer. This can be a challenging but rewarding option for those with a passion for innovation and a willingness to take calculated risks.

Other alternative income streams include affiliate marketing, selling products online, and creating and selling digital products. These options can provide a sense of autonomy and flexibility, as well as the potential for passive income.

In conclusion, diversifying income streams is a key strategy for achieving financial stability and increasing earning potential. By exploring alternative income streams and investing wisely, individuals can reduce their financial risk and create a more secure financial future. So, what’s the best way to earn money? The answer lies in diversifying one’s income streams and exploring new opportunities.

The Power of Passive Income: A Key to Long-Term Financial Freedom

Passive income streams have become increasingly popular in recent years, and for good reason. By generating income without actively working for it, individuals can achieve a level of financial freedom and security that is difficult to attain through traditional employment alone. So, what’s the best way to earn money and achieve long-term financial freedom? The answer lies in harnessing the power of passive income streams.

Real estate investing is one example of a passive income stream that can provide a steady flow of income. By investing in rental properties, individuals can earn rental income without actively working for it. Additionally, real estate values tend to appreciate over time, providing a potential long-term source of wealth.

Dividend-paying stocks are another example of a passive income stream that can provide a regular flow of income. By investing in established companies with a history of paying consistent dividends, individuals can earn a steady stream of income without actively working for it.

Peer-to-peer lending is another option for generating passive income. By lending money to individuals or businesses through online platforms, individuals can earn interest on their investment without actively working for it.

The benefits of passive income streams are numerous. They can provide a sense of financial security, reduce stress and anxiety, and increase overall well-being. Additionally, passive income streams can provide a sense of freedom and flexibility, allowing individuals to pursue their passions and interests without being tied to a traditional 9-to-5 job.

However, it’s essential to note that passive income streams often require an initial investment of time and money. For example, investing in real estate or dividend-paying stocks requires a significant upfront investment. Additionally, passive income streams may require ongoing maintenance and management to ensure their continued success.

Despite these challenges, the benefits of passive income streams make them an attractive option for individuals seeking long-term financial freedom. By harnessing the power of passive income streams, individuals can achieve a level of financial security and freedom that is difficult to attain through traditional employment alone.

Building Multiple Income Streams through Online Opportunities

The internet has opened up a world of opportunities for building multiple income streams. With the rise of e-commerce, online marketplaces, and digital platforms, it’s now possible to earn money from the comfort of your own home. So, what’s the best way to earn money online? The answer lies in exploring the various online opportunities available.

Affiliate marketing is one popular way to earn money online. By promoting products or services of other companies, individuals can earn a commission on sales. This can be done through a website, social media, or email marketing. With the right strategy and marketing techniques, affiliate marketing can be a lucrative way to earn money online.

Selling products on Amazon is another online opportunity that can generate significant income. With millions of customers shopping on Amazon every day, it’s possible to sell a wide range of products and earn a decent income. Whether it’s physical products or digital products, Amazon provides a platform for entrepreneurs to reach a massive audience.

Creating and selling online courses is another way to earn money online. With the rise of online learning, there is a growing demand for courses on various subjects. Whether it’s cooking, photography, or marketing, individuals can create courses and sell them on platforms like Udemy, Teachable, or Skillshare.

Other online opportunities include freelancing, selling ebooks, and creating a YouTube channel or Twitch stream. With the right skills and strategy, it’s possible to earn a significant income from these online opportunities.

However, building multiple income streams online requires effort and dedication. It’s essential to have a clear understanding of the opportunities and challenges involved. Additionally, it’s crucial to stay up-to-date with the latest trends and strategies to succeed in the online world.

Despite the challenges, the benefits of building multiple income streams online make it an attractive option for many. With the flexibility to work from anywhere and the potential for passive income, online opportunities can provide a sense of financial freedom and security.

So, what’s the best way to earn money online? The answer lies in exploring the various online opportunities available and finding what works best for you. With the right strategy and mindset, it’s possible to build multiple income streams online and achieve long-term financial success.

The Importance of Investing in Personal Development for Financial Success

Investing in personal development is a crucial aspect of achieving long-term financial success. By acquiring new skills, knowledge, and expertise, individuals can enhance their earning potential, increase their competitiveness in the job market, and improve their overall financial well-being. So, what’s the best way to earn money and achieve financial success? The answer lies in investing in personal development.

Learning new skills is an essential part of personal development. With the rapid pace of technological change, it’s essential to stay up-to-date with the latest trends and technologies in your industry. This can be achieved through online courses, workshops, and conferences. By acquiring new skills, individuals can enhance their earning potential, increase their job prospects, and improve their overall financial stability.

Building a professional network is another critical aspect of personal development. By connecting with like-minded individuals, entrepreneurs, and industry leaders, individuals can gain access to valuable advice, mentorship, and job opportunities. This can be achieved through attending industry events, joining professional organizations, and participating in online communities.

Developing a personal brand is also essential for achieving financial success. By establishing a strong online presence, creating valuable content, and showcasing your expertise, individuals can attract new business opportunities, increase their earning potential, and improve their overall financial stability.

In addition to these strategies, investing in personal development can also involve reading books, articles, and blogs, listening to podcasts, and seeking out mentorship from experienced professionals. By committing to ongoing learning and self-improvement, individuals can stay ahead of the curve, adapt to changing market conditions, and achieve long-term financial success.

While investing in personal development requires time, effort, and resources, the benefits far outweigh the costs. By acquiring new skills, building a professional network, and developing a personal brand, individuals can enhance their earning potential, increase their competitiveness in the job market, and improve their overall financial well-being.

In conclusion, investing in personal development is a critical aspect of achieving long-term financial success. By committing to ongoing learning and self-improvement, individuals can stay ahead of the curve, adapt to changing market conditions, and achieve their financial goals.

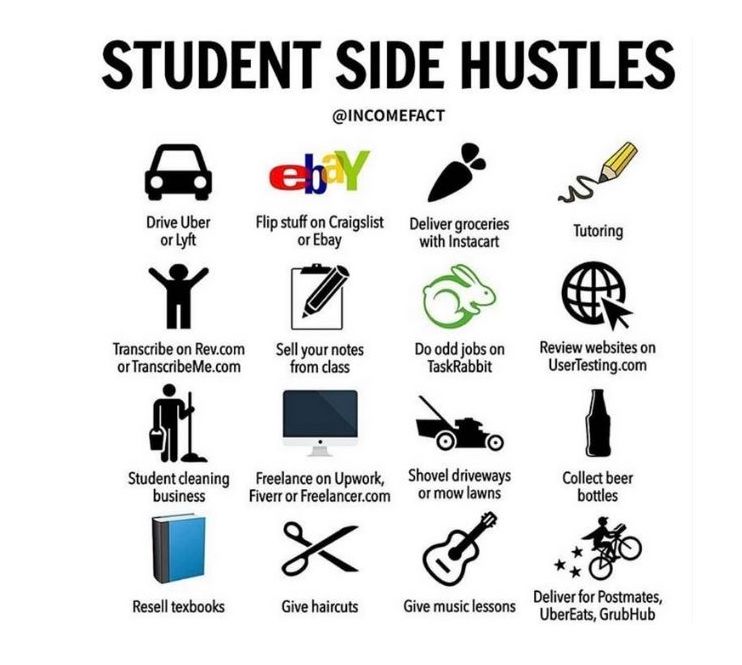

How to Create a Side Hustle that Generates Consistent Income

Creating a side hustle that generates consistent income can be a great way to supplement your primary income and achieve long-term financial success. With the rise of the gig economy and online platforms, it’s easier than ever to start a side hustle and earn extra money. So, what’s the best way to earn money through a side hustle? The answer lies in identifying a profitable niche, creating a business plan, and marketing your products or services effectively.

Identifying a profitable niche is the first step in creating a successful side hustle. This involves researching the market, identifying gaps in the market, and finding a niche that aligns with your skills and interests. Some popular side hustles include freelance writing, graphic design, social media management, and online tutoring.

Creating a business plan is also essential for a successful side hustle. This involves setting clear goals, defining your target market, and outlining your marketing and sales strategy. A business plan will help you stay focused and ensure that your side hustle is profitable and sustainable.

Marketing your products or services is also crucial for a successful side hustle. This involves creating a professional website, using social media to promote your business, and networking with potential clients. You can also use online platforms such as Upwork, Fiverr, or Freelancer to find clients and promote your services.

Another key aspect of creating a successful side hustle is to be consistent and persistent. This involves setting aside dedicated time to work on your side hustle, staying organized, and continuously improving your skills and services.

In addition to these strategies, it’s also important to stay up-to-date with the latest trends and technologies in your industry. This involves attending workshops, webinars, and conferences, and reading industry blogs and publications.

By following these tips and strategies, you can create a side hustle that generates consistent income and helps you achieve long-term financial success. Remember to stay focused, persistent, and always be looking for ways to improve and grow your business.

Creating a side hustle can be a fun and rewarding experience, and it can also provide a sense of financial security and freedom. So, what’s the best way to earn money through a side hustle? The answer lies in identifying a profitable niche, creating a business plan, and marketing your products or services effectively.

Managing Finances Effectively for Long-Term Wealth Creation

Managing finances effectively is crucial for long-term wealth creation. By creating a budget, saving regularly, and investing wisely, individuals can set themselves up for financial success and achieve their long-term goals. So, what’s the best way to earn money and manage finances effectively? The answer lies in creating a solid financial plan and sticking to it.

Creating a budget is the first step in managing finances effectively. This involves tracking income and expenses, identifying areas for cost-cutting, and allocating funds towards savings and investments. A budget should be realistic, flexible, and tailored to individual financial goals.

Saving regularly is also essential for long-term wealth creation. This involves setting aside a portion of income each month and allocating it towards short-term and long-term savings goals. Savings can be used to build an emergency fund, pay off debt, and invest in assets such as stocks, bonds, and real estate.

Investing wisely is also critical for long-term wealth creation. This involves identifying investment opportunities that align with individual financial goals and risk tolerance. Investments can include stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Another key aspect of managing finances effectively is to avoid debt and high-interest loans. This involves paying off high-interest debt, avoiding credit card debt, and using debt consolidation strategies to simplify finances.

In addition to these strategies, it’s also important to stay informed about personal finance and investing. This involves reading books, articles, and blogs, attending seminars and workshops, and seeking advice from financial professionals.

By following these tips and strategies, individuals can manage their finances effectively and set themselves up for long-term wealth creation. Remember to stay disciplined, patient, and informed, and to always keep long-term financial goals in mind.

Managing finances effectively requires time, effort, and discipline, but the rewards are well worth it. By creating a solid financial plan and sticking to it, individuals can achieve financial freedom and security, and live the life they want.

Staying Motivated and Focused on Long-Term Financial Goals

Staying motivated and focused on long-term financial goals is crucial for achieving financial success. By setting clear goals, tracking progress, and celebrating milestones, individuals can maintain momentum and stay on track towards achieving their financial objectives. So, what’s the best way to earn money and stay motivated? The answer lies in creating a solid financial plan and staying committed to it.

Setting clear goals is the first step in staying motivated and focused on long-term financial goals. This involves identifying specific financial objectives, such as saving for a down payment on a house, paying off debt, or building an emergency fund. Goals should be specific, measurable, achievable, relevant, and time-bound (SMART) to ensure they are realistic and attainable.

Tracking progress is also essential for staying motivated and focused on long-term financial goals. This involves regularly reviewing financial statements, tracking expenses, and monitoring progress towards goals. By tracking progress, individuals can identify areas for improvement, make adjustments as needed, and stay motivated to continue working towards their goals.

Celebrating milestones is also important for staying motivated and focused on long-term financial goals. This involves recognizing and celebrating progress towards goals, no matter how small. By celebrating milestones, individuals can stay motivated and encouraged to continue working towards their financial objectives.

Another key aspect of staying motivated and focused on long-term financial goals is to avoid procrastination and stay disciplined. This involves creating a schedule and sticking to it, avoiding distractions, and staying focused on financial goals. By staying disciplined and avoiding procrastination, individuals can maintain momentum and stay on track towards achieving their financial objectives.

In addition to these strategies, it’s also important to stay informed about personal finance and investing. This involves reading books, articles, and blogs, attending seminars and workshops, and seeking advice from financial professionals. By staying informed, individuals can make informed decisions about their finances and stay motivated to continue working towards their financial goals.

By following these tips and strategies, individuals can stay motivated and focused on long-term financial goals and achieve financial success. Remember to stay committed, disciplined, and informed, and to always keep long-term financial goals in mind.

Staying motivated and focused on long-term financial goals requires time, effort, and discipline, but the rewards are well worth it. By creating a solid financial plan and staying committed to it, individuals can achieve financial freedom and security, and live the life they want.