Understanding the Credit Score Range: What’s the Highest Possible Score?

Credit scores are a crucial aspect of personal finance, and understanding the credit score range is essential for achieving financial stability. The most widely used credit scoring models, FICO and VantageScore, use a range of 300 to 850 to determine an individual’s creditworthiness. But what’s the highest credit score possible? The answer is 850, but achieving this perfect score is extremely rare.

In the United States, the average credit score is around 700, according to data from Experian. However, having a high credit score can significantly impact loan and credit applications, interest rates, and credit limits. A high credit score can lead to better loan terms, lower interest rates, and increased credit limits. On the other hand, a low credit score can result in higher interest rates, lower credit limits, and even loan rejection.

The credit score range is divided into five categories: excellent (750+), good (700-749), fair (650-699), poor (600-649), and bad (below 600). Understanding these categories is crucial for determining the impact of credit scores on loan and credit applications. For instance, an individual with an excellent credit score (750+) can expect to qualify for the best loan terms, including low interest rates and high credit limits.

So, what’s the highest credit score possible? As mentioned earlier, the highest possible credit score is 850. However, achieving this perfect score requires a long history of responsible credit behavior, including on-time payments, low credit utilization, and a diverse credit mix. Even then, it’s extremely rare to achieve a perfect credit score, as the credit scoring models are designed to reward responsible credit behavior over time.

In conclusion, understanding the credit score range is essential for achieving financial stability. By knowing the highest possible credit score and the impact of credit scores on loan and credit applications, individuals can take steps to improve their credit scores and achieve better financial outcomes. Whether you’re looking to improve your credit score or maintain a high credit score, understanding the credit score range is crucial for making informed financial decisions.

How to Achieve an Exceptional Credit Score: Expert Tips and Strategies

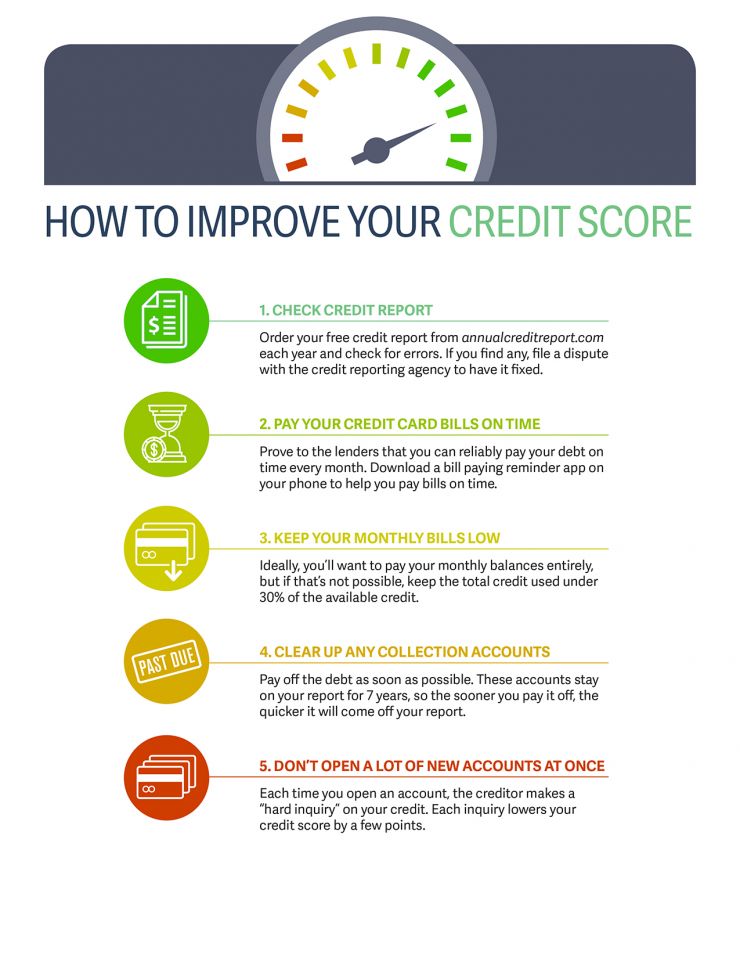

Achieving an exceptional credit score requires a combination of financial discipline, patience, and smart credit management strategies. By following these expert tips, individuals can improve their credit scores and unlock better loan terms, lower interest rates, and increased credit limits.

First and foremost, paying bills on time is crucial for maintaining a healthy credit score. Late payments can negatively impact credit scores, so it’s essential to set up payment reminders or automate payments to ensure timely payments. Additionally, keeping credit utilization low is vital, as high credit utilization can indicate to lenders that an individual is a high-risk borrower. Aim to keep credit utilization below 30% for all credit accounts.

Monitoring credit reports is also essential for maintaining a high credit score. By obtaining free credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax), individuals can identify errors, inaccuracies, and negative marks that may be impacting their credit scores. Disputing errors and working to resolve negative marks can help improve credit scores over time.

Avoiding negative marks is also critical for maintaining a high credit score. This includes avoiding late payments, collections, and bankruptcies, which can all negatively impact credit scores. By avoiding these common mistakes, individuals can maintain a healthy credit score and avoid costly interest rates and fees.

Finally, patience and long-term financial habits are essential for achieving an exceptional credit score. Building a strong credit history takes time, so it’s essential to focus on making consistent, responsible financial decisions over the long-term. By doing so, individuals can achieve a high credit score and unlock better financial opportunities.

In addition to these strategies, individuals can also consider the following tips to improve their credit scores:

- Make on-time payments for all bills and debts

- Keep credit utilization below 30% for all credit accounts

- Monitor credit reports regularly and dispute errors

- Avoid applying for too many credit cards or loans

- Build a diverse credit mix, including credit cards, loans, and a mortgage

By following these expert tips and strategies, individuals can improve their credit scores and achieve better financial outcomes. Remember, achieving an exceptional credit score takes time and patience, but the benefits are well worth the effort.

Credit Score Tiers: What’s Considered Excellent, Good, Fair, and Poor?

Credit scores are categorized into different tiers, each with its own set of implications for loan and credit applications. Understanding these tiers is essential for individuals seeking to improve their credit scores and achieve better financial outcomes.

The credit score tiers are as follows:

- Excellent: 750+

- Good: 700-749

- Fair: 650-699

- Poor: below 650

Individuals with excellent credit scores (750+) are considered to be low-risk borrowers and can expect to qualify for the best loan terms, including low interest rates and high credit limits. Those with good credit scores (700-749) are also considered to be low-risk borrowers, but may not qualify for the same level of benefits as those with excellent credit scores.

On the other hand, individuals with fair credit scores (650-699) are considered to be moderate-risk borrowers and may face higher interest rates and lower credit limits. Those with poor credit scores (below 650) are considered to be high-risk borrowers and may struggle to qualify for loans and credit cards.

The implications of each credit score tier on loan and credit applications are significant. For example, individuals with excellent credit scores may qualify for interest rates as low as 3.5% on a mortgage, while those with poor credit scores may face interest rates as high as 10% or more.

In addition to the interest rates, credit score tiers also impact the approval rates for loan and credit applications. Individuals with excellent credit scores are more likely to be approved for loans and credit cards, while those with poor credit scores may be rejected or face stricter terms and conditions.

Understanding the credit score tiers is essential for individuals seeking to improve their credit scores and achieve better financial outcomes. By knowing which tier they fall into, individuals can take steps to improve their credit scores and qualify for better loan terms and lower interest rates.

For example, individuals with fair credit scores may focus on paying bills on time, keeping credit utilization low, and monitoring credit reports to improve their credit scores. Those with poor credit scores may need to take more drastic measures, such as seeking credit counseling or considering a secured credit card.

Ultimately, understanding the credit score tiers is crucial for achieving financial stability and security. By knowing which tier they fall into, individuals can take steps to improve their credit scores and achieve better financial outcomes.

The Impact of Credit Score on Loan and Credit Applications

Credit scores play a significant role in determining the outcome of loan and credit applications. Lenders use credit scores to assess the creditworthiness of applicants and determine the level of risk involved in lending to them. A high credit score can lead to better loan terms, lower interest rates, and increased credit limits, while a low credit score can result in higher interest rates, lower credit limits, and even loan rejection.

One of the most significant impacts of credit score on loan and credit applications is the interest rate. Borrowers with high credit scores can qualify for lower interest rates, which can save them thousands of dollars in interest payments over the life of the loan. For example, a borrower with a credit score of 750 may qualify for a mortgage interest rate of 3.5%, while a borrower with a credit score of 650 may qualify for a mortgage interest rate of 4.5%.

In addition to interest rates, credit scores also impact the approval rates for loan and credit applications. Borrowers with high credit scores are more likely to be approved for loans and credit cards, while those with low credit scores may be rejected or face stricter terms and conditions. For example, a borrower with a credit score of 800 may be approved for a credit card with a credit limit of $10,000, while a borrower with a credit score of 600 may be approved for a credit card with a credit limit of $2,000.

Credit scores also impact the credit limits offered by lenders. Borrowers with high credit scores may qualify for higher credit limits, which can provide them with more flexibility and financial freedom. For example, a borrower with a credit score of 750 may qualify for a credit card with a credit limit of $20,000, while a borrower with a credit score of 650 may qualify for a credit card with a credit limit of $5,000.

Furthermore, credit scores can also impact the types of loan and credit products available to borrowers. For example, borrowers with high credit scores may qualify for premium credit cards with rewards and benefits, while those with low credit scores may only qualify for basic credit cards with higher interest rates and fees.

In conclusion, credit scores have a significant impact on loan and credit applications. A high credit score can lead to better loan terms, lower interest rates, and increased credit limits, while a low credit score can result in higher interest rates, lower credit limits, and even loan rejection. By understanding the impact of credit score on loan and credit applications, borrowers can take steps to improve their credit scores and achieve better financial outcomes.

Common Mistakes That Can Lower Your Credit Score

Even with a solid understanding of credit scores and a commitment to maintaining good credit habits, it’s easy to make mistakes that can lower your credit score. Being aware of these common pitfalls can help you avoid them and keep your credit score on track. Here are some of the most common mistakes that can negatively impact your credit score:

1. Late Payments: Payment history accounts for 35% of your credit score, so making late payments can significantly lower your score. Set up payment reminders or automate your payments to ensure you never miss a payment.

2. High Credit Utilization: Keeping high credit utilization can harm your credit score. Try to keep your credit utilization ratio below 30% for all credit accounts. Aim to use less than 10% of your available credit for the best scores.

3. Applying for Too Many Credit Cards: Applying for multiple credit cards in a short period can negatively affect your credit score. Only apply for credit when necessary, and space out your applications if you need to apply for multiple lines of credit.

4. Closing Old Accounts: Closing old accounts can harm your credit utilization ratio and credit age, both of which are important factors in determining your credit score. Consider keeping old accounts open and using them sparingly to maintain a positive credit history.

5. Not Monitoring Credit Reports: Failing to monitor your credit reports can lead to errors and inaccuracies going unnoticed. Check your credit reports regularly to ensure they’re accurate and up-to-date.

6. Having Too Many Credit Inquiries: Applying for credit can result in a hard inquiry, which can temporarily lower your credit score. Limit your credit applications and space them out to minimize the impact on your score.

7. Not Paying Off Debt: Failing to pay off debt can lead to collections, which can significantly lower your credit score. Create a debt repayment plan and stick to it to avoid collections and maintain a healthy credit score.

8. Co-Signing Loans: Co-signing loans can put your credit score at risk if the primary borrower fails to make payments. Be cautious when co-signing loans, and make sure you understand the risks involved.

Avoiding these common mistakes can help you maintain a healthy credit score and achieve the highest possible credit score. Remember, a high credit score requires ongoing effort and attention to your credit habits. By being mindful of these potential pitfalls, you can keep your credit score on track and enjoy better loan terms and lower interest rates.

How Long Does it Take to Improve Your Credit Score?

Improving your credit score requires time, effort, and a solid understanding of how credit scores work. The amount of time it takes to improve your credit score depends on various factors, including the current state of your credit, the effectiveness of your credit-building strategies, and the frequency of credit reporting updates.

Generally, credit scores can change over time due to changes in credit habits, new credit accounts, and updates to credit reports. Here’s a breakdown of the typical timeframe for improving credit scores:

1. 30-60 days: This is the typical timeframe for credit reporting updates. If you’ve made recent changes to your credit habits, such as paying off debt or opening a new credit account, it may take around 30-60 days for these changes to be reflected in your credit score.

2. 3-6 months: If you’re working to improve your credit utilization ratio or pay off debt, you may start to see improvements in your credit score within 3-6 months. This is because credit scoring models take into account recent credit activity, and consistent positive habits can lead to score increases.

3. 6-12 months: At this stage, you may start to see more significant improvements in your credit score, especially if you’ve been consistently practicing good credit habits. This is because credit scoring models give more weight to longer-term credit behavior, and a year’s worth of positive habits can lead to substantial score increases.

4. 1-2 years: If you’re looking to achieve a high credit score, such as 750 or above, it may take around 1-2 years of consistent effort. This is because high credit scores require a long history of positive credit behavior, low credit utilization, and a diverse mix of credit accounts.

5. 2-5 years: For those who have experienced significant credit setbacks, such as bankruptcies or foreclosures, it may take longer to recover and achieve a high credit score. In these cases, it’s essential to focus on rebuilding credit over the long-term, rather than expecting quick fixes.

Remember, improving your credit score is a marathon, not a sprint. It requires ongoing effort, patience, and a commitment to maintaining good credit habits. By understanding the timeframe for improving credit scores, you can set realistic expectations and work towards achieving a high credit score over time.

What’s the highest credit score you can achieve? While it’s extremely rare to achieve a perfect credit score of 850, it’s possible to get close with consistent effort and a solid understanding of credit scoring models. By following expert tips and strategies, you can improve your credit score and enjoy better loan terms, lower interest rates, and greater financial flexibility.

Monitoring Your Credit Report: Why It’s Crucial for a High Credit Score

Monitoring your credit report is a crucial step in maintaining a high credit score. Your credit report is a detailed record of your credit history, including information about your credit accounts, payment history, and credit inquiries. By regularly reviewing your credit report, you can ensure that it’s accurate and up-to-date, which is essential for achieving and maintaining a high credit score.

Why is monitoring your credit report so important? Here are a few reasons:

1. Errors and inaccuracies: Credit reports can contain errors or inaccuracies, which can negatively impact your credit score. By monitoring your credit report, you can identify and dispute any errors or inaccuracies, which can help to improve your credit score.

2. Negative marks: Negative marks, such as late payments or collections, can significantly lower your credit score. By monitoring your credit report, you can identify any negative marks and take steps to address them, such as paying off outstanding debts or disputing errors.

3. Credit inquiries: Credit inquiries can also negatively impact your credit score, especially if you have multiple inquiries in a short period. By monitoring your credit report, you can see who has accessed your credit report and when, which can help you to avoid applying for too much credit at once.

How can you monitor your credit report? Here are a few steps you can take:

1. Obtain a free credit report: You can obtain a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. You can request your free credit report online or by mail.

2. Review your credit report: Once you have your credit report, review it carefully to ensure that it’s accurate and up-to-date. Look for any errors or inaccuracies, as well as any negative marks or credit inquiries.

3. Dispute errors: If you find any errors or inaccuracies on your credit report, dispute them with the credit reporting agency. You can do this online or by mail, and you’ll need to provide documentation to support your dispute.

4. Monitor your credit report regularly: It’s a good idea to monitor your credit report regularly to ensure that it’s accurate and up-to-date. You can set up alerts with the credit reporting agencies to notify you of any changes to your credit report.

By monitoring your credit report regularly, you can help to ensure that it’s accurate and up-to-date, which is essential for achieving and maintaining a high credit score. Remember, a high credit score can help you to qualify for better loan terms, lower interest rates, and greater financial flexibility. What’s the highest credit score you can achieve? With regular credit monitoring and a solid understanding of credit scoring models, you can work towards achieving a high credit score and enjoying the many benefits that come with it.

Maintaining a High Credit Score: Ongoing Strategies for Success

Maintaining a high credit score requires ongoing effort and attention to your credit habits. By following these strategies, you can ensure that your credit score remains high and continues to benefit your financial health.

1. Regular Credit Monitoring: Regularly monitoring your credit report is essential for maintaining a high credit score. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your report carefully to ensure that it’s accurate and up-to-date.

2. Credit Utilization Management: Keeping your credit utilization ratio low is crucial for maintaining a high credit score. Aim to use less than 30% of your available credit, and avoid maxing out your credit cards. By keeping your credit utilization ratio low, you can demonstrate to lenders that you’re able to manage your debt responsibly.

3. Avoiding New Credit Inquiries: Applying for too many credit cards or loans can negatively impact your credit score. Avoid applying for new credit unless absolutely necessary, and space out your applications if you need to apply for multiple lines of credit.

4. Building a Long Credit History: A long credit history is essential for maintaining a high credit score. Avoid closing old accounts, as this can negatively impact your credit age. Instead, focus on building a long credit history by keeping old accounts open and using them sparingly.

5. Diversifying Your Credit: A diverse mix of credit accounts can help to improve your credit score. Aim to have a mix of different credit types, such as credit cards, loans, and a mortgage. By diversifying your credit, you can demonstrate to lenders that you’re able to manage different types of debt responsibly.

6. Avoiding Negative Marks: Negative marks, such as late payments or collections, can significantly lower your credit score. Avoid making late payments, and work to resolve any outstanding debts or collections. By avoiding negative marks, you can maintain a high credit score and enjoy better loan terms and lower interest rates.

By following these ongoing strategies, you can maintain a high credit score and enjoy the many benefits that come with it. Remember, a high credit score can help you to qualify for better loan terms, lower interest rates, and greater financial flexibility. What’s the highest credit score you can achieve? With regular credit monitoring, credit utilization management, and a long credit history, you can work towards achieving a high credit score and enjoying the many benefits that come with it.

Maintaining a high credit score requires ongoing effort and attention to your credit habits. By following these strategies, you can ensure that your credit score remains high and continues to benefit your financial health. With a high credit score, you can enjoy better loan terms, lower interest rates, and greater financial flexibility. Start working towards a high credit score today, and enjoy the many benefits that come with it.